GST & TAX Services

Corporate Tax

All Singapore registered companies must submit annual tax to IRAS authority as part of statutory compliance

With Singapore Corporate Annual Tax Return Service, we keep you updated, compliant with tax rules as well as optimize your tax savings to reinvest into your business.

Singapore has excellent tax benefits for small-to-midsize companies.

- Singapore has excellent tax benefits for small-to-midsize companies. These apply if you set up a new company here.

- For profits around S$300,000, the overall tax rate is still a low 17% (Year of Assessment 2010 onwards).

- Startups that meet certain qualifying conditions can claim for tax exemption under the Tax Exemption for start up scheme

GOODS & SERVICES TAX (GST)

Goods and Services Tax or GST is a broad-based consumption tax levied on Import of Goods, the import(collected by Singapore Customs), as well as nearly all supplies of goods and services in Singapore. In other countries, GST is known as the Value-Added Tax or VAT.

GST exemptions apply to the provision of most financial services, the sale and lease of residential properties, and the importation and local supply of investment precious metals. Goods that are exported and international services are zero-rated.

What happens at AGM?

What happens at AGM?

As a business, you MUST register for GST when your taxable turnover exceeds $1million.

If your business does not exceed $1 million in taxable turnover, you may still choose to voluntarily register for GST after careful consideration.

Charging and Collecting GST

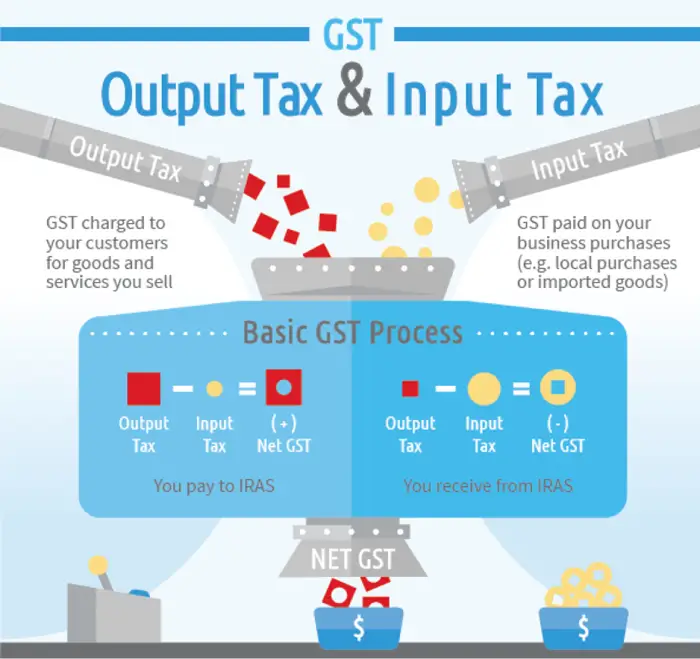

Once you have registered for GST, you must charge GST on your supplies at the prevailing rate with the exception of relevant supplies that are subject to customer Accounting. This GST that is charged and collected is known as Output Tax. Output tax must be paid to IRAS.

The GST that you incur on business purchases and expenses (including import of goods) is known as Input Tax. If your business satisfies the conditions for claiming input tax, you can claim the input tax on your business purchases and expenses.

This input tax credit mechanism ensures that only the value added is taxed at each stage of a supply chain.

Paying Output Tax and Claiming Input Tax Credits

As a GST-registered business:

- You must submit your GST return to IRAS one month after the end of each prescribed accounting period. This is usually done on a quarterly basis.

- You should report both your output tax and input tax in your GST return.

- The difference between output tax and input tax is the net GST payable to IRAS or refunded by IRAS.

Get A Free Quote

What Our Clients Say About Singapore Incorporation

Neels Consultancy expertly handled our company setup in Singapore. Their comprehensive services, including nominee director and secretarial support, made the process seamless and stress-free. Highly recommended!

Are You Ready For Start A New Business? Contact Us Now!

Establish a credible and professional presence in Singapore with our prestigious registered office address service. Contact us today to learn more about our packages and how we can help enhance your business image.